Are you considering using the Flipkart Pay Later service? It provides a convenient way for shopping on Flipkart. With a Flipkart Pay Later, you can purchase products instantly but pay later. The IDFC First Bank initiated this service in collaboration with Flipkart. However, for certain reasons, you may need to close this account.

Today, we will go through a simple guideline on how to close Flipkart Pay Later service. Kindly read the entire post so that you don’t miss important tips.

Flipkart Pay Later Financial Service: What You Must Know First

Whether you want to open a Flipkart Pay Later account or close it, there are a few crucial things that you must know. Perhaps, you want to change your decision regarding opening or closing a Flipkart Pay Later account after knowing these facts.

Without further ado, let’s get to know these crucial facts.

What is Flipkart Pay Later?

Flipkart Pay Later is a financial service provided by IDFC First Bank Ltd. It allows you to make purchases on Flipkart instantly. But you can pay for them at a later date, which is the main benefit. It is a convenient option if you want to shop without immediately paying the full amount.

How to Confirm Flipkart Pay Later on Your CIBIL Report

To verify if Flipkart Pay Later is associated with your CIBIL report, you can inspect the report for a mention of IDFC First Bank Ltd. This confirmation step can maintain transparency in your financial records.

Checking Your Loan/Pay Later Accounts on CIBIL

To have a comprehensive view of your financial commitments, review the list of loan or pay later accounts on your CIBIL report. This way, you can keep track of your financial engagements and plan accordingly.

Canceling Flipkart Pay Later Account

If, for any reason, you decide to cancel your Flipkart Pay Later account, the process involves reaching out to Flipkart Customer Support. It is important to note that contacting IDFC First Bank directly for cancellation assistance won’t be fruitful. Be sure to follow the correct channels for a smooth cancellation process.

Customer Support Information

For any queries or assistance related to Flipkart Pay Later, always reach out to Flipkart Customer Support. They are your go-to source for information and assistance, including cancellation requests.

How to Close Flipkart Pay Later Account Forever

There are several reasons to permanently close your Flipkart Pay Later account. You may need to close such an account to manage your CIBIL score, change payment methods, or curb excessive spending.

You must follow these steps carefully to close a Flipkart Pay Later account:

Step 1: Log into Your Flipkart Account

The first step is to log into your Flipkart account using your verified email or phone number. Also, provide the password combination you used during the creation of the account.

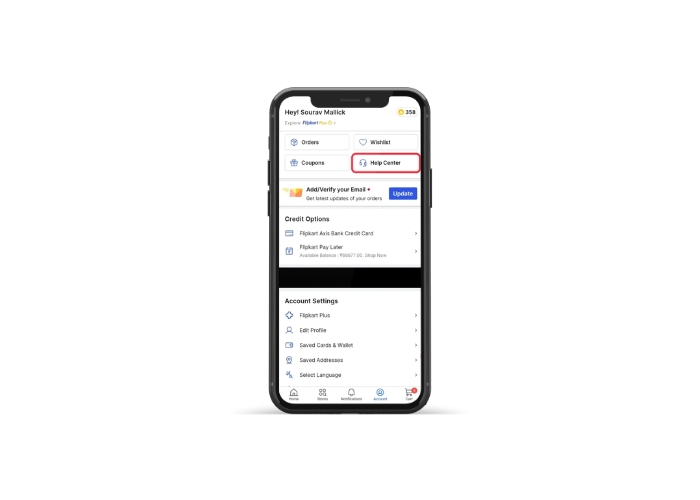

Once logged in, head to the Flipkart Help Center. Look for the user icon. Typically, it can be found in the upper right corner of the page.

Step 3: Find the ‘Chat’ or ‘Callback’ Option

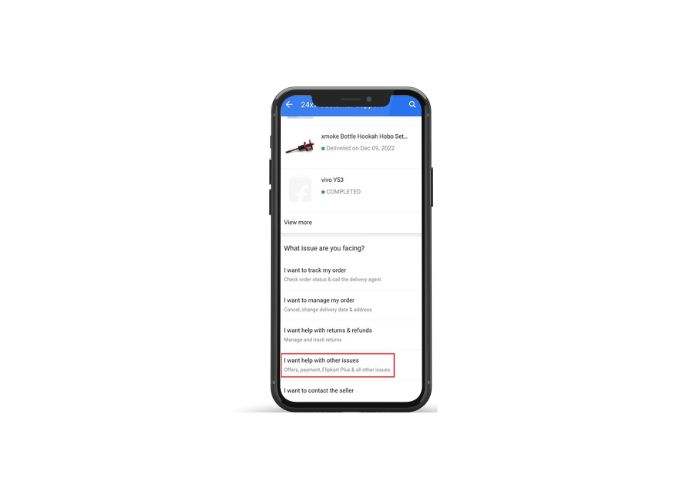

Within the Help Center, locate the “I want help with other issues” option. Click on it, then proceed to the “Others” section at the bottom of the list. Click on “Other” in the drop-down. Here, you will find the “Request for a Callback” or “Chat” option.

Step 4: Request a Call Back

It is better to select the “Request for a Callback” option rather than “Chat.” Expect a call from a Flipkart customer representative within 5 to 10 minutes. When connected, politely ask the support team to assist you in permanently closing your Flipkart Pay Later IDFC bank account. Make it clear that you want a permanent closure, not just deactivation or a temporary pause.

Step 5: Time for Account Closure

Following the phone conversation, your Flipkart Pay Later account closure process will begin. Normally, the process will take about a month to complete. Be patient during this period. The closure status will be updated on your CIBIL report as “closed” within 2 to 3 months. This will confirm the permanent closure of your Flipkart Pay Later account.

Reach Out to the RBI Ombudsman

If you encounter issues with your financial services, including your Flipkart Pay Later account, the Reserve Bank of India (RBI) Ombudsman is there to help. We have listed the steps below to reach out to them and address your concerns.

1. Understand the Role of RBI Ombudsman

The RBI Ombudsman is a neutral entity for handling complaints related to financial services. This includes concerns about your Flipkart Pay Later account. They act as a mediator between you and the financial institution.

2. Collect Relevant Information

Before reaching out to the RBI Ombudsman, gather all relevant information about your complaint. They may ask for details about your Flipkart Pay Later account, transaction records, and any communication with Flipkart or IDFC First Bank. Having this information will strengthen your case.

3. Submit Your Complaint

To submit your complaint, you need to find the contact details. Just visit the official RBI website to find details about the RBI Ombudsman. Clearly explain the situation. If necessary, outline the steps you have already taken to resolve the issue. Provide as much detail as possible to help them understand the nature of your concern.

4. Be Patient

After submitting your complaint, allow some time for the RBI Ombudsman to review and address your case. They will work to mediate a resolution between you and the concerned financial institution.

5. Follow Up if Necessary

If you don’t receive a timely response, or if you have additional information to share, don’t hesitate to follow up with the RBI Ombudsman. Communication is key in resolving any financial dispute.

Important Tips for Closing Flipkart Pay Later Account

Now, you might have learned how to close Flipkart Pay Later service. However, that is not enough unless you know the following tips.

- Before initiating the closure, clear all pending dues on your Flipkart Pay Later account. It may hinder the closure process if you fail to do so.

- Sometimes, closing an account may lead to a temporary decrease in your credit score. Don’t be alarmed; it is a normal and short-term occurrence.

- Upon successful closure, request a No Objection Certificate (NOC) from your lending provider. This document confirms that your Flipkart Pay Later account is closed with no outstanding dues. If you don’t receive it within 2 to 3 weeks, proactively ask for it.

- Even after closure, your Flipkart Pay Later account will be displayed on your CIBIL report. It will remain as a ‘closed’ account for record-keeping purposes. This information will stay on your report for a few years.

- If you have no credit cards and Flipkart Pay Later is your first credit line, consider keeping it active. Maintaining a mix of ‘Credit Card’ and ‘Loan’ accounts can positively influence your credit profile.

- If you are not currently using your Flipkart Pay, but expect to need credit in the future, keep the account open. This can contribute to a positive credit history when applying for credit cards or loans later.

Conclusion

Flipkart Pay Later is a convenient financial service provided by IDFC First Bank. It allows you to defer payments for your Flipkart purchases. We have listed the steps on how to close Flipkart Pay Later account permanently. Along with following those steps, stick to the correct procedure for canceling your Flipkart Pay Later account.